INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

- Prime Minister Modi Visits Punjab’s Adampur Air Base, Interacts with Airmen after Successful ‘Operation Sindoor’; Stern Message to Pakistan

- The layered Air Defence systems that worked superbly, the key element of Operation Sindoor

- Operation Sindoor | Day 2 DGMOs Briefing

- Operation Sindoor: India strikes back with Precision and Purpose

- Operation Sindoor: Resolute yet Restrained

- India’s Operation Sindoor Sends a Clear Message to Terror and the World – ‘ZERO TOLERANCE’

- Japan and India set forth a defence cooperation consultancy framework, talks on tank and jet engines

- Terrorist Attack in Pahalgam in Kashmir: Unfolding a long surgical war against PAK

- Lt General Pratik Sharma takes over Command of Indian Army's Northern Command

India's biggest submarine programme

P-75(India) breaks off the ground; Germany leads strategic partnership

What is brewing in India's biggest military project – P-75(India) for the next-generation submarine? After all the trials, deliberation and delays, the unfolding of P-75(I) will redefine the Indian military acquisition process which is based on the unprecedented thrust on full technology transfer and IPs. With Germany readying for Strategic Partnership, the race is clear.

Project-75(India) which is dubbed as one of the mega projects for the Indian Navy in building a next-generation submarine finally seems to be getting out of the troubled water. The long-haul procedural deals under the Strategic Partnership model with foreign partners made it the most complex military acquisition process unfolding today. While the deal is still in the fray with Germany and Spain going forward with separate trials, the key issues are resolved. What will be the outcome?

Project-75(India), dubbed as one of the mega projects for the Indian Navy in building a next-generation submarine, finally seems to be getting out of troubled waters

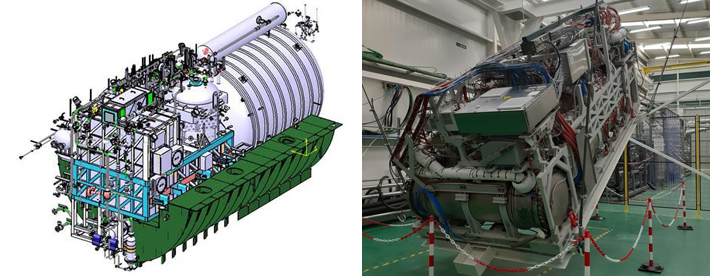

The ambitious P-75(I) was conceived with the plan for the indigenous construction of six conventional submarines through Transfer of Technology (ToTs). Here, India aimed to acquire and absorb significant technology and create a tiered industrial ecosystem for submarine construction in India built on the existing Kalvari-Class submarine. However, the Project strived for new technology- the Air Independent Propulsion System (AIP) for its submarine, loaded advanced missile systems and torpedoes. Additionally, the P-75(I) looked at associated shore support, engineering support package, training and spares package with contemporary equipment, weapons & sensors.

After a long delay, the trials began in March this year when a team of the Indian Navy visited Kiel in Germany to inspect key elements of the submarine -- the AIP system -at German submarine manufacturer ThyssenKrupp Marine Systems (TKMS).

The only other contender, Navantia, a Spanish state-owned shipbuilding company that builds vessels for the military and civil sectors will conduct the second phase of the trial in Spain in June. They would demonstrate the AIP system. Spain's Navantia and Larsen & Toubro had signed a Teaming Agreement (TA) to submit a techno-commercial bid for the Indian Navy's P-75(India) submarine programme.

P-75(I): Policy and procedural ambiguity under SP Model

In June 2019, the Ministry of Defence (MoD) issued an Expression of Interest (EoI) for shortlisting Indian Strategic Partners (SP) in collaboration with foreign original equipment manufacturers (FOEMs) under Project-75(I) of the Indian Navy. The idea of the SP model, opening to DPSU and Private players was a fairly new chapter in the Defence Acquisition Procedure (DAP-2020), which is the overarching policy guidelines for the acquisition of military equipment.

The very concept built up on the indigenisation push. Besides, worldwide, such large defence contracts were negotiated and done based on a higher degree of tech transfer, Joint Intellectual Property (IP) control and local production/manufacturing. In fact, in a report published in 2015 which was to evaluate such a mechanism, headed by V.K. Aatre, former Scientific Adviser to the Defence Minister, laid down criteria for selecting Strategic Partners (SPs) from the private defence industry.

The initial capability plan was based on strengthening the existing submarines and gaps, beginning with the contract for six Scorpene submarines (Kalvari-class) worth ₹18,706 crores signed in 2005

Initially, the project moved in the right direction, achieving the approval of the Defence Acquisition Council (DAC) for progressing the project under the Strategic Partnership (SP) Model in 2019. The project was formally initiated in 2007 with the granting of the Acceptance of Necessity (AoN) with the plan to induct 12 conventional submarines by 2012 and another 12 by 2030.

The key elements of P-75(I) submarines sought to build indigenous capacity in the domestic private defence industry through the SPM.

The initial capability plan was based on strengthening the existing submarines and gaps, beginning with the contract for six Scorpene submarines (Kalvari-class) worth ₹18,706 crores was signed in 2005, which later escalated to about ₹23,000 crore. Again, the DAC approved three additional Scorpenes in July 2023.

Reinforcing such a plan, in June 2019, the MoD issued the EoI for the P-75(I). The terms were laid out for the Indian companies and foreign partners. According to the initial draft, the Indian entity must have the shipbuilding capability and financial strength while the FOEMs would be selected on their 'submarine design meeting the Indian Navy's Qualitative Requirements and qualifying the Transfer of Technology and Indigenous Content (IC) criteria'.

From the very beginning, the key issue remained – Air Independent Propulsion (AIP) Systems, which the Indian Navy sought for the submarines under the P-75(I)

The DAC in January 2020 shortlisted MDL and private sector shipbuilder Larsen and Toubro (L&T) to tie up with any of the five foreign submarine builders as strategic partners. Initially, there were five international bidders (FOEMs) which included Naval Group-DCNS (France), Rubin Design Bureau (Russia), ThyssenKrupp Marine Systems (Germany), Saab group and Navantia (Spain). Later with the entry of the South Korean' defence entity, Daewoo, the total bidders expanded to six.

Beginning with the request for proposal (RfP) for P-75(I) in July 2021, the delays over the mega projects began to surface due to the failing response deadline, leading to extending the deadline to December 2022 and then being deferred to 2023. The RfP of July 2021 shortlisted two Indian strategic partners, Mazagaon Dock Limited (MDL) and L&T. The P-75(I) mandated sea proven Fuel-Cell based AIP (Air Independent Propulsion) Plant with contemporary equipment, weapons & sensors, advanced torpedoes, modern missiles (indigenous) and state of the art countermeasure systems.

The Critical delays: Technology (AIP) and strategic collaboration (FOEMs)

From the very beginning, the key issue remained –AIP Systems which the Indian navy sought out for its unique capability for the submarines under the P-75(I).

The French Naval Group in May 2022 announced that it would not be able to participate in the project, given that the RfP includes a sea-proven operational AIP system, which it did not possess. Further, the liability clause exacerbated the contractual obligation as it also happened in many other cases of such high-stake defence acquisitions. Russia also withdrew, sighting liability clause but mostly on technology- transfer on their part as some of the reports explain.

Later, a Korean defence conglomerate Hanwha Ocean (which took over Daewoo Shipbuilding and Marine Engineering in May 2023) also withdrew from the P-75(I) for which it was in talks with Indian defence conglomerate L&T, despite having a proven track record for joint-development and production of land-based K-9 Vajra Artillery system for the Indian Army. However, it was not clear from the beginning whether Hanwha Ocean did possess AIP in its full operational capacity as the trials were already underway for submarines in South Korea.

Last, the Swedish defence company SAAB sought withdrawal from the project, citing the "ownership issues" which again emanated from the FDI limits on account of the DAP 2020 under which the Foreign OEM could have 49 per cent under the SP Model while the Indian entity will hold the majority stake.

After the initial hiccups, TKMS and Navantia are the only two international bidders with their Indian partners — MDL and L&T. Finally, TKMS signed an agreement with MDL during the visit of German Defence Minister Boris Pistorius to India in June 2023. While it was a loosely formed non-binding and non-financial Memorandum of Understanding (MoU), nonetheless it cleared the toughened stance of the German government. It was evident that India had asked Germany for the full transfer of technologies (ToTs) for the submarine, including the full spectrum of submarine manufacturing from design to development.

However, it was not without the push from the government from both sides. Firstly, the German bidder, ThyssenKrupp Marine Systems (TKMS) was itself undergoing a makeover under its parent company –ThyssenKrupp's restructuring plan. Besides, there was a political difference within Germany's coalition party where the Green Party vehemently opposed it.

As per the foundational and contractual obligation, as reported, TKMS agreed to collaborate on comprehensive design and engineering with MDL. Initially, the focus will remain on design and improvement – if that allows specific weapon integration, involving the Naval Design Bureau and MDL. Notably, in the past, India had procured submarines from Germany as the four HDW Class 209 submarines built in the 1980s. Additionally, Germany also agreed to the repair and overhaul of the second of the HDW submarines, INS Shankush in July 2023, worth over $300 million. More so, the Indo-German cooperation also extended to the first submarine INS Shishumar for the Medium Refit Cum Life Certification (MRLC) which was signed in 2018.

On the other side, Spain's Navantia and L&T moved ahead for the submission of techno-commercial bids for the submarine project in in July 2023. Navantia's offered its latest submarine in the making. Navantia has also offered their expertise with full TOTs like integrating their new age AIP system known as BEST "Bio-Ethanol Stealth Technology", which has been developed together with the Spanish Company Abengoa and the American Collins Aerospace, working under a sub-contract by Navantia. However, as it is learnt, Navantia is also undergoing sea-worthy trials for its AIP-fitted submarine and requires a lengthy time frame for the final certification. It is unclear how the Spanish naval warship maker will fulfil the terms of "Operational AIP". Notably, in a similar time frame, India's DRDO which has already come up with a miniaturised version of the AIP will be able to provide full systems indigenously with much lesser cost. This weakens the case for Navantia as a foreign partner with no proven sea-worthy AIP systems.

In a nutshell, Germany's TKMS remains the number one choice until Navantia offers something magnificent in terms of the full spectrum of design tech and development over the years despite having a proven and leading Indian private defence entity as a partner.

P-75(I) - Out of the troubled water?

Building a modern submarine is by all accounts a highly complex engineering process as the difficulty is compounded when all equipment needs to be miniaturised with fail-proof and stringent quality controls.

In the quest for indigenisation, there is no doubt that the P-75(I) will break ground in achieving full-scale capabilities. The foundational technical know-how gained over the years with Scorpene Class submarine — while limited in capability — will also add value in optimising the design and development process. While the partnership between MDL and the Naval Group has been successful in building six Kalvari-class submarines, based on France's Scorpene submarine, it does not empower and equip MDL to build a new class of submarine on its own. Here, even the government admits that the role of private entities will add greater strength and effort to indigenisation. This proves to be a great boon for L&T for its proven track record of on-time delivery. As a senior naval expert points out, "It is high time that the submarine project be put forth with private players like L&T as it brings competition, efficiency and accountability."

The long-haul procedural deals under the Strategic Partnership model with foreign partners made it the most complex military acquisition process unfolding today

Project-75(I) will provide an opportunity for local manufacture of state-of-the-art submarines which will enable the Indian Navy to dominate the undersea domain in our area of interest whilst parallelly providing the Indian industry with an opportunity for long-term partnership in not only submarine construction but also maintenance, logistics and maintenance support. In all aspects, the P-75(I) will be one of the first mega military projects which lays the ground for indigenous next-generation submarines with open design architecture and development of the Indian Navy with potential for export to friendly partners globally.

Besides, taking account of the impending conflict and operational readiness, the P-75(I) calls for urgency. In light of China's constant maritime expansionism in the Indian Ocean Region (IOR), it becomes imperative that the navy addresses the acquisition issues in the time frame which is already delayed. On another front, Pakistan has already moved ahead with the acquisition of eight 039 Yuan class submarines from China with AIP capability by 2028. Multiple conflicts in the sea have widely extended the role of the Indian Navy in the Indo-Pacific.

The Project-75(I) cost is nearly ₹45,000 crores which might increase with new state-of-the-art weapon systems. This is the second project under the latest Strategic Partnership (SP) Model, with the first being the procurement of 111 Naval Utility Helicopters (NUH) which failed to take off.

Manish Kumar Jha is a Consulting & Contributing Editor for SP's Aviation, SP's Land Forces and SP's Naval Forces and a security expert. He writes on national security, military technology, strategic affairs & policies.